To build all of the solar panels, wind turbines, electric vehicle batteries, and other technologies necessary to fight climate change, we’re going to need a lot more metals. Mining those metals from the Earth creates damage and pollution that threaten ecosystems and communities. But there’s another potential source of the copper, nickel, aluminum, and rare-earth minerals needed to stabilize the climate: the mountain of electronic waste humanity discards each year.

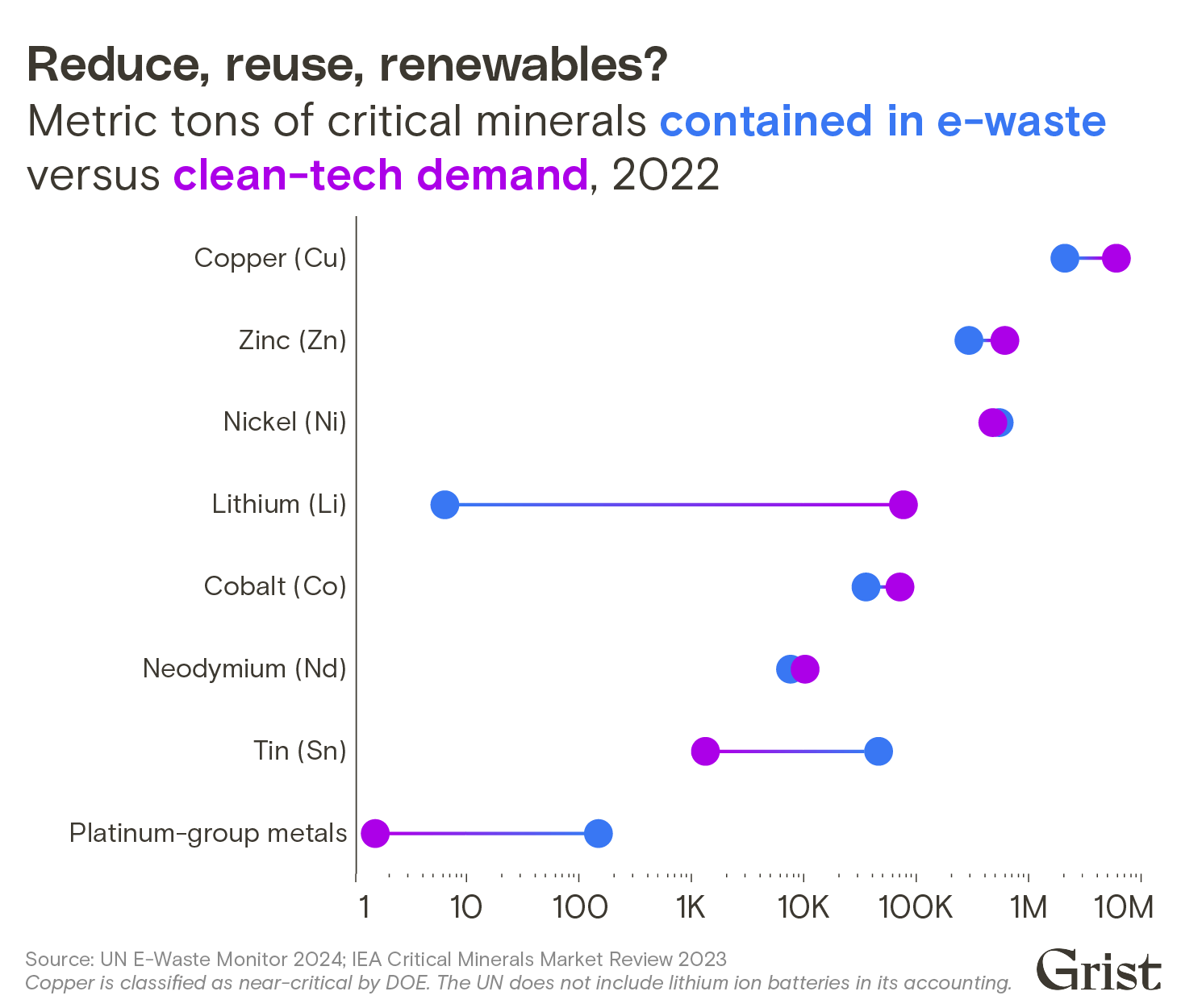

Exactly how much of each clean energy metal is there in the laptops, printers, and smart fridges the world discards? Until recently, no one really knew. Data on more obscure metals like neodymium and palladium, which play small but critical roles in established and emerging green energy technologies, has been especially hard to come by.

Now, the United Nations has taken a first step toward filling in these data gaps with the latest installment of its periodic report on e-waste around the world. Released last month, the new Global E-Waste Monitor shows the staggering scale of the e-waste crisis, which reached a new record in 2022 when the world threw out 62 million metric tons of electronics. And for the first time, the report includes a detailed breakdown of the metals present in our electronic garbage, and how often they are being recycled.

“There is very little reporting on the recovery of metals [from e-waste] globally,” lead report author Kees Baldé told Grist. “We felt it was our duty to get more facts on the table.”

One of those facts is that some staggering quantities of energy transition metals are winding up in the garbage bin.

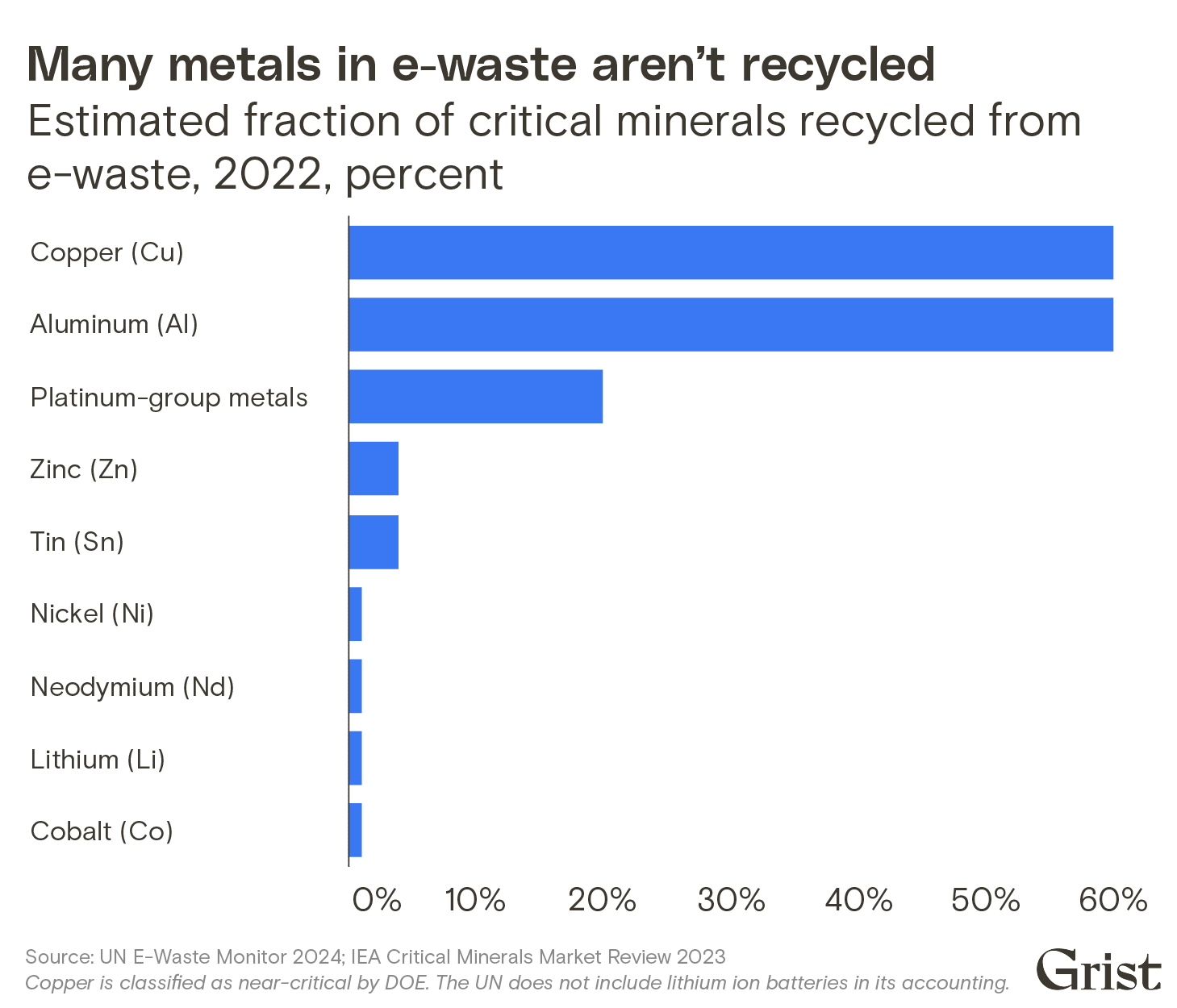

Two of the most recyclable metals found abundantly in e-waste are aluminum and copper. Both are slated to play essential roles in the energy transition: Copper wiring is prevalent in a range of low- and zero-carbon technologies, from wind turbines to the power transmission lines that carry renewable energy. Aluminum is also used in some power lines, and as a lightweight structural support metal in electric vehicles, solar panels, and more. Yet only 60 percent of the estimated 4 million metric tons of aluminum and 2 million metric tons of copper present in e-waste in 2022 got recycled. Millions of tons more wound up in waste dumps around the world.

The world could have used those discarded metals. In 2022, the climate tech sector’s copper demand stood at nearly 6 million metric tons, according to the International Energy Agency, or IEA. In a scenario where the world aggressively reduces emissions in order to limit global warming to 1.5 degrees Celsius, copper demand for low-carbon technologies could nearly triple by 2030.

Aluminum demand, meanwhile, is expected to grow up to 80 percent by 2050 due the pressures of the energy transition. With virgin aluminum production creating over 10 times more carbon emissions than aluminum recycling on average, increased recycling is a key strategy for reining in aluminum’s carbon footprint as demand for the metal rises.

For other energy transition metals, recycling rates are far lower. Take the rare-earth element neodymium, which is used in the permanent magnets found in everything from iPhone speakers to electric vehicle motors to offshore wind turbine generators. Worldwide, Baldé and his colleagues estimated there were 7,248 metric tons of neodymium locked away in e-waste in 2022 — roughly three-quarters of the 9,768 metric tons of neodymium the wind and EV sectors required that year, per the IEA. Yet less than 1 percent of all rare earths in e-waste are recycled due to the immaturity of the underlying recycling technologies, as well as the cost and logistical challenges of collecting rare earth-rich components from technology.

“It’s a lot of hassle to collect and separate out” rare-earth magnets for recycling, Baldé said. Despite the EV and wind energy sectors’ fast-growing rare-earth needs, “there is no push from the market or legislators to recover them.”

The metals present in e-waste aren’t necessarily useful for every climate tech application even when they are recycled. Take nickel. The lithium-ion batteries inside electric vehicles gobble up huge amounts of the stuff — over 300,000 metric tons in 2022. The amount of nickel required for EVs could rise tenfold by 2050, according to the IEA. But while the world’s e-waste contained more than half a million metric tons of nickel in 2022, most of it was inside alloys like stainless steel. Rather than getting separated out, that nickel gets “recycled into other steel products,” said Kwasi Ampofo, the lead metals and mining analyst at energy consultancy BloombergNEF. Some of that recycled steel could wind up in wind turbines and other zero-emissions technologies. But it won’t directly help to fill the much larger nickel demands of the EV battery market.

In other cases, e-waste might represent a significant supply of a specialized energy transition metal. Despite being present in tiny amounts, certain platinum group metals — found on printed circuit boards and inside medical equipment — are already recycled at high rates due to their value. Some of these metals, such as palladium, are used in the production of catalysts for hydrogen fuel cell vehicles, said Jeremy Mehta, technology manager at the Department of Energy’s Advanced Materials and Manufacturing Technologies Office. “Recycling palladium from e-waste could help meet the growing demand for these metals in fuel cell technologies and clean hydrogen production, supporting the transition to clean energy,” Mehta said.

For the energy transition to take full advantage of the metals present in e-waste, better recycling policies are needed. That could include policies requiring that manufacturers design their products with disassembly and recycling in mind. Josh Blaisdell, who manages the Minnesota-based metals recycling company Enviro-Chem Inc., says that when a metal like copper isn’t getting recycled, that’s usually because it’s in a smartphone or other small consumer device that isn’t easy to take apart.

In addition to design-for-recycling standards, Baldé believes metal recovery requirements are needed to push recyclers to recover some of the non-precious metals present in small quantities in e-waste, like neodymium. To that end, in March, the European Council approved a new regulation that sets a goal that by 2030, 25 percent of “critical raw materials,” including rare-earth minerals, consumed in the European Union will come from recycled sources. While this is not a legally binding target, Baldé says it could “create the legislative push” toward metal recovery requirements.

Harvesting more of the metals inside e-waste will be challenging, but there are many reasons to do so, Mehta told Grist. That’s why, last month, the Department of Energy, or DOE, launched an e-waste recycling prize that will award up to $4 million to competitors with ideas that could “substantially increase the production and use of critical materials recovered from electronic scrap.”

“[W]e need to increase our domestic supply of critical materials to combat climate change, respond to emerging challenges and opportunities, and strengthen our energy independence,” said Mehta of the DOE. “Recycling e-scrap domestically is a significant opportunity to reduce our reliance on hard-to-source virgin materials in a way that is less energy intensive, more cost effective, and more secure.”