Too often I’m writing depressing things, so now I’m going to turn my attention to some good news. It turns that while I was off hiatus-ing, ol’ King Coal was having a rough go of it. As regular readers know, coal is the enemy of the human race, so every bit of ill fortune that befalls it is like the peal of an angel’s trumpet, a distant melody of hope. Let’s review.

1. Coal is retiring

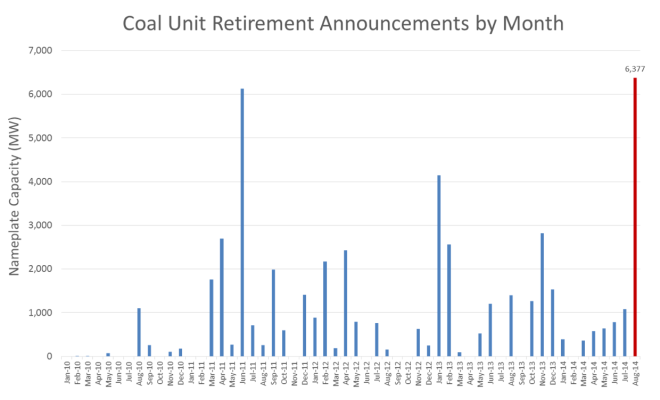

August saw the announced retirement of 6,377 megawatts worth of coal generation, the highest of any month since the beginning of 2010:

This is testament to the extraordinary ongoing success of the grassroots anti-coal movement in the U.S. Every coal plant involved in that total represents a long and tenacious ground battle fought by local coalitions, and not in coastal liberal enclaves, either, but in Indianapolis, Missouri, and Tennessee. The movement can now boast the announced shutdown of over 500 coal units and more than 175 full coal plants. Measured by carbon avoided or social capital created, that’s pretty badass.

Meanwhile, a month earlier in July, 100 percent of new generating capacity in the U.S. came from clean sources. The switch is underway. We’re just fighting over timing.

2. Coal exports are constipated

The big news on coal exports is that Ambre Energy is not going to build its proposed Morrow Pacific coal export project, which would have shipped 8.8 million tons of coal a year down the Columbia River and off to Asia. In August, the Oregon Department of State Lands denied Ambre a crucial land permit; a few days ago, the U.S. Army Corps of Engineers announced that all permitting for the project would be suspended indefinitely.

That’s four down. The two remaining U.S. export terminal proposals, Gateway Pacific (which is in trouble) and Longview, are the two biggest. And they’re both in Washington, which, rumor has it, boasts a green-leaning governor.

Over at Sightline — the definitive source for news on the Pacific Northwest coal fight — Clark Williams-Derry gives a fuller accounting of Coal’s Terrible Month. It’s fun reading.

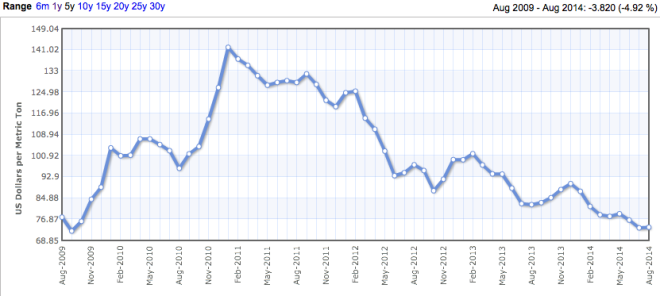

Meanwhile, here’s Pacific Rim coal prices for the last five years:

Better get those exports going, before they’re worthless! Remember what Goldman Sachs said:

New investments in thermal coal infrastructure, unless they come online quickly, will miss a rapidly closing window for profitability. In coming years, there won’t be enough demand growth to justify such investments.

Wouldn’t that be sad.

3. Coal leasing gets a wake-up call

As I and many others have written, the fact that coal companies are allowed to lease public land at dirt-cheap rates, mine coal on it, and sell the coal for a huge profit, often overseas, is a travesty. It substantially offsets the good Obama has done with fuel-economy standards, carbon regulations, etc. When we ship the coal overseas to be burned (often at coal plants with fewer pollution controls), we don’t count the emissions as “ours.” That way, coal company bosses make lots of money and the U.S. government takes none of the carbon responsibility.

In June, after green groups sued over one of the leases, a federal judge called that practice into question. The Boston Globe has the story:

In a key case involving land around Somerset [Colorado], a federal judge ruled in June that the Obama administration, allying itself with the nation’s second-largest coal firm [Arch Coal], had failed to even take into account the “social cost of carbon” when calculating the value of the coal lease. He put the lease on hold, and environmentalists promptly prepared lawsuits designed to stop the entire lease program.

Now, this judgement might be overturned by a higher, more conservative court, but either way, green groups are going to use it as a wedge. It’s going to put a spotlight on coal leasing that might prove politically uncomfortable if it gets hot enough. Siding with coal companies against the climate isn’t very good “optics,” as they say in the biz.

A few months earlier, the nonpartisan Government Accountability Office released a report critical of the leasing program. The Center for American Progress has one too. So does Sightline, and Greenpeace, and WildEarth Guardians. Reporters are starting to ask questions and the administration is feeling some pressure, as SNL reports:

Asked about the apparent contradiction between the coal lease sale and the new White House report on the impact of delaying climate change mitigation efforts, Dan Utech, the special assistant to the president for energy and climate change, told reporters that “the BLM is looking at some standards for venting and flaring of methane emissions associated with production on federal lands and I think also looking at some leasing reforms potentially for leasing of coal on federal lands.”

Utech acknowledged concerns about the coal leasing program raised by the Interior inspector general and GAO. “We look at climate and other environmental impacts of all federal actions,” he added. “I think anything we do in that space would be no exception.”

Hmm.

What would it mean for BLM to take the social cost of carbon into effect? Lots. But I’ll be writing more about that later.

4. China’s not gonna buy all that coal anyway

As mentioned above, the market for Pacific Rim coal is cratering and would-be coal exporters face, as Goldman Sachs put it, a “rapidly closing window for profitability.” Will that market ever rebound? Will China go back to the insane coal-fueled growth of the early ’00s?

Doubtful. Coal is strangling China, with air pollution so bad it’s causing social upheaval. In response, provincial governments are announcing aggressive coal controls. When it comes to China there’s always considerable doubt about how effectively controls will be implemented (and how to verify if they are), but if the controls are implemented … well, damn. Greenpeace ran the numbers:

- 12 of China’s 34 provinces, accounting for 44% of China’s coal consumption, have pledged to implement coal control measures.

- Collectively, the coal control measures imply a reduction in coal consumption of approximately 350 million tonnes (MT) by 2017 and 655 MT by 2020, compared with business-as-usual growth. This translates into an estimated reduction in CO2 emissions of about 700 MT in 2017 and 1,300 MT in 2020.

- The major slowdown in coal consumption trends opens up a window of opportunity for peaking global CO2 emissions. Implementing the coal control measures could put China’s emissions almost in line with a 2 degrees trajectory.

- China’s coal consumption has already slowed down recently, with a number of key provinces seeing absolute consumption decreases in 2012.

- In magnitude, the scale of emission reductions resulting from coal control measures compares to or exceeds the efforts of the other top two polluters – European Union and the United States. [my emphasis]

As you can see, this is a Big F’in Deal. (And this is to say nothing of the carbon market China reportedly plans to implement as early as 2016.)

As Jeff Goodell noted in his superb Rolling Stone piece, what China decides to do about coal will more or less determine the fate of the world.

So at least on the coal front, there may just be a glimmer of hope.