Knotty problem: A sugar beetPhoto: GrabeIn 2008, the USDA approved planting of Monsanto’s Roundup Ready sugar beet, equipped with a gene that allows them to withstand unlimited doses of Monsanto’s Roundup herbicide.

Knotty problem: A sugar beetPhoto: GrabeIn 2008, the USDA approved planting of Monsanto’s Roundup Ready sugar beet, equipped with a gene that allows them to withstand unlimited doses of Monsanto’s Roundup herbicide.

The sugar trade promised to be a big money maker for genetically modified (GM) seed giant Monsanto, as these beets — a special super-sweet variety, not the kind you find at the farmers market — account for 44 percent of U.S. sugar production.

Sure enough, Monsanto rapidly conquered the market. By this year’s spring planting, Monsanto’s patented GM seeds covered a jaw-dropping 95 percent of sugar beet fields. (Monsanto has managed to quietly turn the American sweet tooth into a gold mine — it also dominates the seed market for corn, the source of the number-one U.S. sweetener, high-fructose corn syrup.)

But back in August, Monsanto suffered yet another of a continuing line of setbacks, when a federal judge effectively nixed the USDA’s approval of GM sugar beets. The agency had failed to adequately assess the environmental impact of planting the high-tech seeds, the judge ruled.

On Monday, a USDA economist released a report (via Bloomberg) estimating that the ban on GM sugar beet seeds would cut U.S. total sugar production by 20 percent in 2011, due to the the “limited availability of conventional seed.”

Let’s ponder that for a moment. As recently as 2008, sugar beet farmers relied exclusively on conventional seeds; the GM ones weren’t commercially available. Two years later, GM seeds dominate the market, and the conventional market has been essentially wiped out.

This story isn’t about a shortage of sweetener in the United States. Even if U.S. sugar production falls 20 percent next year, food processors will still have plenty of cheap sweetener available with which to churn out junk food.

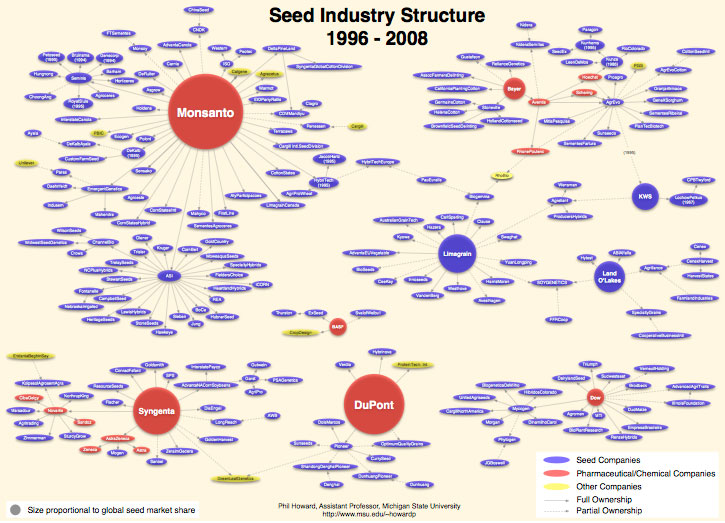

The issue is a shortage of real diversity in the seed supply. As Phil Howard of Michigan State University has documented extensively — illustrated by his chart below — the last decade has seen massive consolidation in the seed industry.

And now a single company peddling a patent-protected, ecologically dodgy product can effectively wipe out non-GM alternatives in just two years. Let’s hope the U.S. Justice Department, which is investigating Monsanto’s dominance of the GM seed market, reads that USDA report closely.

Seed grab: Consolidation has increased in the international seed industry in recent decades, and Monsanto has come to dominate the market.Chart: Phil Howard/MSU

Seed grab: Consolidation has increased in the international seed industry in recent decades, and Monsanto has come to dominate the market.Chart: Phil Howard/MSU